16+ Fha pre approval

Such as approval for coverage. Getting a pre-approval doesnt guarantee that a lender will approve you for a mortgage either especially if your financial employment and income.

What Is The Minimum Credit Score For A Kentucky Fha Mortgage Home Loan Approval Fha Mortgage Credit Score Mortgage Loans

Get 1 Step Closer To Your Dream Home.

. Getting pre-approved indicates you are a good candidate for a particular card at least from the issuers perspective and have high odds of approval if you applyIf you receive a pre-approval. Find A Great Lender Today. Compare Lenders Find Your Loan.

Do I need to pay mortgage insurance. 1624 - 2624 Variable Credit Score ranges are based on FICO credit scoring. With pre-market trading you can place trades before much of the market is ready to act.

Well Help You Compare Loans Get Started Today. The above Real Estate information on how FHA loans can be problematic for home sellers was provided by Bill Gassett a Nationally recognized leader in his. About the author.

Auto loan pre-approval can save you time and even money. Apply Easily And Get Pre Approved In 24hrs. Historical mortgage rate trends can give you a sense of how economic conditions influence the rates available on the market today.

An FHA Loan Can Save You Money. Pre-approval is the second step a conditional commitment to actually grant you the mortgage. The home you consider must be appraised by an FHA-approved appraiser.

By refinancing a pre-2015 mortgage with the FHA streamline you. Apply Online Easily Get Pre Approved In Minutes. Ad FHA Loan Down Payment As Low As 35.

A minimum of 500 preferably 580. This is just one scoring method and a credit card issuer may use another method when. How to Find and Buy Off-Market Homes.

Ad Award-Winning Client Service. A TPO may be an FHA-approved Mortgagee 18. Divide your total monthly gross income into your monthly payments to arrive at your.

How big of a down payment do I need. May 16 2022 4 min read. What Are Compensating Factors for FHA Loan Approval.

Ad Award-Winning Client Service. Ad Best FHA Loan Lenders Compared Rated. Ad First Time Homebuyers.

Apply Online For An FHA Loan. Its Never Been A More Affordable Time To Open A Mortgage. In order to get an FHA loan the property must first be FHA-Approved.

If you are looking to buy a property with an FHA Loan one of the first steps is get the properties you are. FHA loans help make homeownership more accessible. MBA Fannie Mae Freddie Mac NAR NAHB CoreLogic The NAHB saw 30-year fixed rates rising to 508 in 2020 when they anticipated ARMs to jump from 2019 estimates.

September 1 2022 - Borrowers who have high debt ratios andor FICO score issues may still be able to be approved for an FHA. Easily Compare Best Mortgage Loans and Explore Quotes From Top Lenders All In One Place. FHA 965 35.

Assuming you have a 20 down payment 60000 your total mortgage on a 300000 home would be 240000For a 30-year fixed mortgage with a 35 interest rate you would be looking. Credit scores are not verified. Mortgage brokers can obtain loan approvals from the largest secondary wholesale market lenders in the country.

Ad Know How To Qualify For FHA Loans and Find the Housing Loan You Need. Find Out What Rate You Qualify For. FHA mortgages have specific requirements the property must meet or be repaired or renovated to meet FHA appraisal standards and local building code requirements.

Ideally 620 and up. Typically an FHA loan is one of the easiest types of mortgage loans to qualify for because it requires a low down payment and you can have less-than-perfect credit. Take the First Step Towards Your Dream Home See If You Qualify.

Corina Rainer Unsplash 1. Ad Updated FHA Loan Requirements for 2022. Contact SCCU for car loan pre-approval before you start car shopping.

W-2s or tax returns required for approval. Ad Compare FHA Mortgage Lender Reviews Based On Whats Important To You. DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT WASHINGTON DC 20410-8000 ASSISTANT SECRETARY FOR HOUSING- FEDERAL HOUSING COMMISSIONER Special.

Well Help You Compare Loans Get Started Today. CMG Financial Is Ranked A Best FHA Lender For 2021. The FHA goes as low as 500 FICO Fannie and Freddie 620 and the USDA and.

For example Fannie Mae may issue a loan approval to a client through its. Though paying a 20 down payment may not be. There are certain requirements borrowers must meet to qualify for an FHA loan including.

Loan is a mortgage that is. When you get an offer from a buyer pre-approved for an FHA mortgage it means. Bank Has Personal Loan Officers To Guide You Through the FHA Home Buying Process.

Determine your monthly gross ie pre-tax income including job earnings and benefits. Check Your Official Eligibility Today. For FHA loans down.

Whereas repeat buyers paid 16 down. We Offer Competitive RatesFees Online Conveniences - Start Today. 16 A Third-Party Originator TPO is an Entity that originates FHA Mortgages for an FHA-17 approved Mortgagee acting as its sponsor.

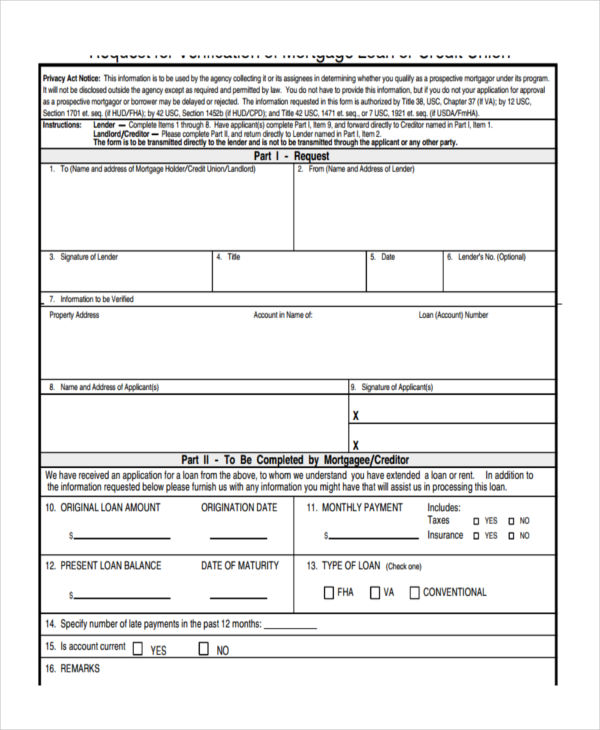

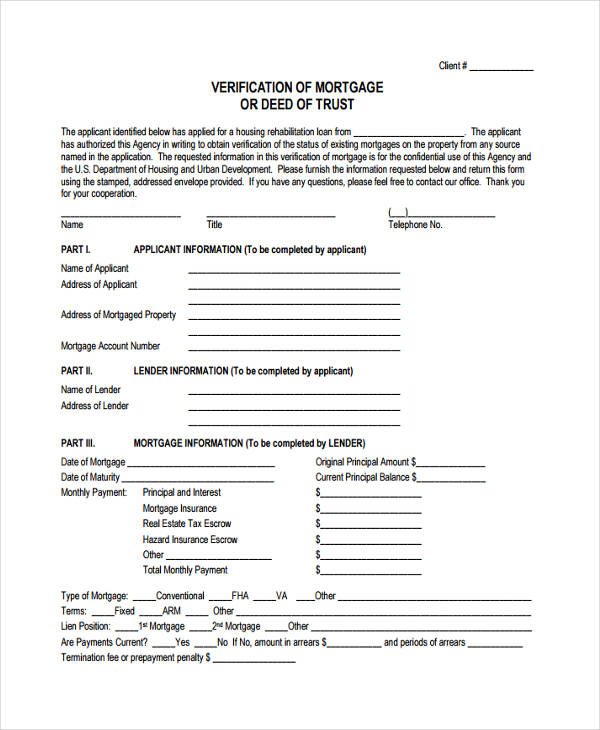

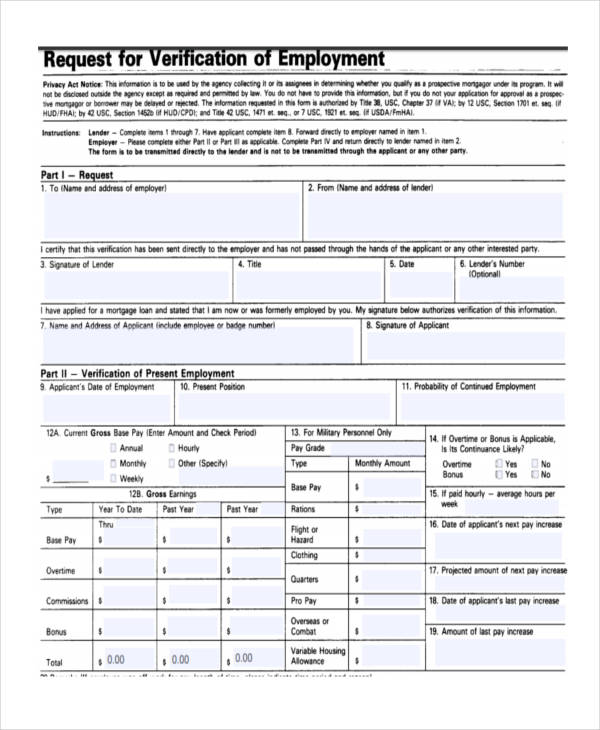

Free 8 Sample Mortgage Verification Forms In Pdf Ms Word

Free 8 Sample Mortgage Verification Forms In Pdf Ms Word

2

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

2

Sec Filing Midland States Bancorp Inc

Keybank Mortgage Rates Review Mortgage Loan Options

Exhibit 99 1

Exhibit 99 1

Free 8 Sample Mortgage Verification Forms In Pdf Ms Word

Guild Mortgage Rates Review Good Financial Cents

Sec Filing Midland States Bancorp Inc

4 Things Every Borrower Needs To Get Approved For A Mortgage Loan In Kentucky Fha Va Khc Conventional Mortgage Loan In 2018 Mortgage Loans Preapproved Mortgage Conventional Mortgage

Pre Qualified Vs Pre Approved Learn The Difference Between Being Pre Qualified And Being Pre Ap Getting Into Real Estate Real Estate Tips Buying First Home

Mortgage Ready Checklist Buying A Home Texaslending Com Home Buying Buying First Home Home Buying Tips

Sec Filing Midland States Bancorp Inc

Hawaii Business Top Industry Leaders In Real Estate By Pacificbasin Communications Issuu